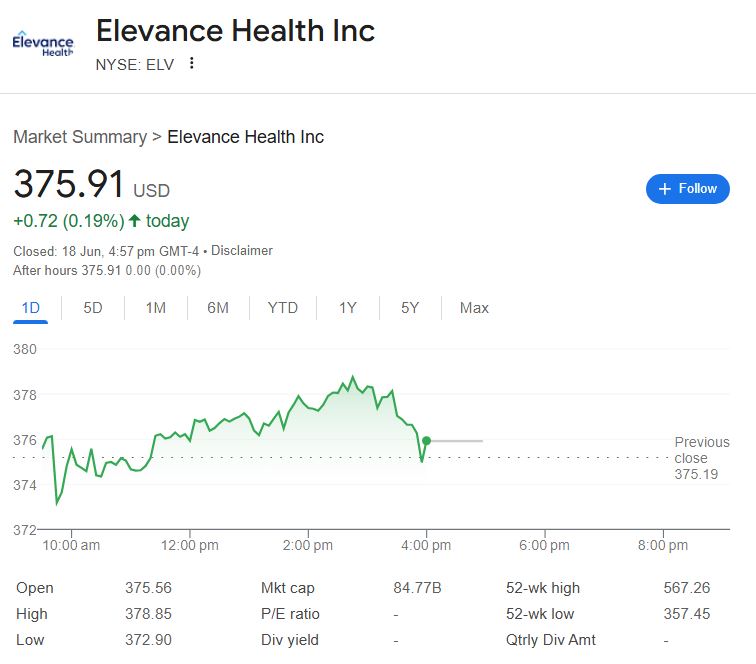

Following a multi-month decline from a 52-week high of $567.26, Elevance Health’s stock has recently been the focus of cautious optimism in investor circles, trading just above $375. Analysts are generally optimistic despite the price compression, which some may perceive as waning momentum. Because of the company’s exceptionally strong fundamentals, many still base their long-term goals around $500.

Elevance’s performance on key metrics has significantly improved as a result of reinvesting in tech-enabled healthcare and utilizing a vast care delivery network. The company reported $48.89 billion in revenue in Q1 2025 alone, a 14.83% increase from the previous year. The net income of $2.18 billion demonstrates both strong margins and well-executed strategies. Long-term investors‘ confidence is strengthened by this financial clarity and strategic positioning.

Elevance Health Inc. – Essential Stock and Corporate Information

| Detail | Information |

|---|---|

| Stock Symbol | ELV (NYSE) |

| Share Price (as of June 18) | $375.91 |

| 52-Week Range | $357.45 – $567.26 |

| Market Capitalization | $84.93 Billion |

| Dividend (Annual) | $6.84 per share (1.82% yield) |

| Return on Equity | 14.24% |

| CEO | Gail Koziara Boudreaux (Since 2017) |

| Headquarters | Indianapolis, Indiana |

| Revenue (2023) | $171.3 Billion |

| Official Website | www.elevancehealth.com |

Consistency is crucial when it comes to healthcare stocks. Elevance (formerly Anthem) exemplifies that quality with a robust return on equity of 14.24%, which is especially advantageous when comparing capital efficiency in the industry. According to this figure, the company outperforms competitors like Centene and Molina, making 14 cents in profit for every $1 in shareholder equity.

Elevance made significant investments in digital transformation during the pandemic, which helped to streamline operations and free up human talent to concentrate on complex care needs. As part of this change, Carelon, its health services subsidiary, was established; it has since grown to be a significant source of income. Elevance has developed highly adaptable platforms through internal development and strategic partnerships, supporting everything from claims automation to behavioral health outreach.

It’s interesting to note that the business has come under scrutiny even though its financial standing is still strong. Although the majority of analysts minimized the significance, insider sales totaling $6.9 million earlier this quarter sparked controversy. These deals are frequently planned in advance and might not show strategic hesitancy. Nonetheless, such actions inevitably raise concerns about internal sentiment when considered against a volatile backdrop and ongoing regulatory discussions.

Nevertheless, Elevance continues to produce free cash flow at a very effective rate. With its most recent levered free cash flow of $7.44 billion, the company has plenty of room to handle debt servicing, dividends, and innovation. For background, Elevance is able to sustain its competitive advantage due to its financial flexibility, especially as healthcare moves toward personalized and value-based care.

Analysts and individual investors will be closely monitoring the July earnings call in the upcoming months. An estimated EPS of $9.19 is projected. If achieved—or surpassed—it would strengthen Elevance’s standing as a reliable performer in a challenging market. A robust quarter from a healthcare leader could drastically alter portfolio flows, especially in light of the recent trend of poor tech results.

Elevance is especially creative in meeting patient needs because of its wide portfolio strategy, which includes acquisitions and care coordination platforms. It has capitalized on a field that is becoming more and more relevant both financially and culturally by incorporating behavioral health services into its core offerings. Recently, public personalities like Simone Biles and Michael Phelps have brought attention to mental health; Elevance’s investment in this field demonstrates that it is actively influencing healthcare delivery models rather than just following trends.

The company’s social relevance is increasing in addition to its profits. Elevance’s scale enables it to stabilize and support regional partners who might otherwise struggle to survive in the face of growing healthcare inequality and staffing pressures throughout the sector. This has a noticeable effect, particularly in underprivileged areas where strong payer-provider collaboration is essential to access to care.

The stock is still surprisingly cheap when viewed through the prism of valuation. Elevance offers both earnings growth and value, which is uncommon in today’s overpriced market, with a forward P/E ratio of 10.59 and a PEG ratio of just 0.68. ELV makes a strong argument for medium-sized funds looking to diversify away from exposure to technology.

Notably, Elevance’s one-year return surpasses 27% in spite of the short-term volatility, which is a much faster rate than the S&P 500’s return during the same time frame. The consistency is even more remarkable. The stock has returned 50.89% over the last five years. Businesses that quietly but effectively compound value are frequently characterized by that kind of longevity and performance.

The temptation for early-stage retail investors may be to pursue hypergrowth plays or gaudy AI stocks. Elevance, on the other hand, provides a radically different route, one based on scalable infrastructure, vital societal services, and steady revenue. Simply put, it’s a stock that helps you get a good night’s sleep.

Elevance has maintained consistent and dependable payouts since the beginning of its dividend program. Although it is modest, the current annual yield of 1.82% is supported by strong fundamentals, which makes it incredibly resilient in volatile markets. This increases its attractiveness to income-focused investors, especially when paired with steady earnings and careful capital allocation.

Further integration of data analytics, AI-assisted diagnostics, and care coordination systems is likely to shape Elevance’s next phase of growth. The company wants to enhance clinical results while lowering administrative burden by combining patient behavior modeling and predictive analytics—a tactic that is both morally and financially sound.