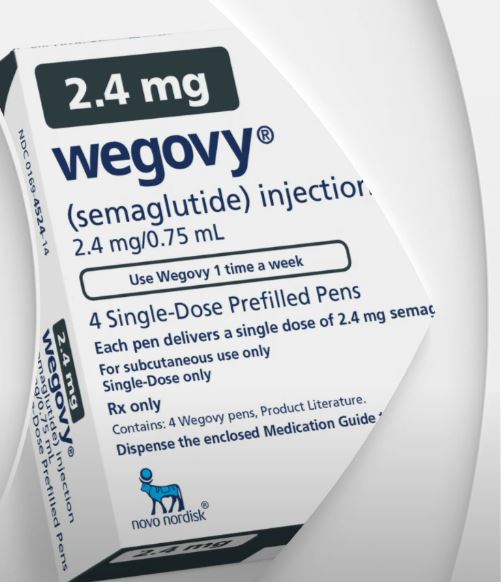

In recent months, Novo Nordisk’s weight-loss medication Wegovy has emerged as the focal point of one of the most closely followed battles in contemporary pharmaceuticals. Wegovy, an injectable GLP-1 receptor agonist that was introduced with the goal of dramatically reducing appetite and promoting weight loss, gained widespread recognition very fast thanks to the positive recommendations of both doctors and celebrities. Several A-list actors and Silicon Valley founders have been discreetly utilizing semaglutide-based treatments as part of their transformation journeys over the past year. They frequently cite the drug’s remarkably effective appetite-reducing properties as a game changer.

By the middle of 2025, Wegovy had established itself in important foreign markets, such as India, where it faced off against Zepbound, a rival drug made by Eli Lilly. Its domestic growth was turbulent at the same time. Even though Wegovy’s sales increased 67% in the second quarter of 2025, Novo Nordisk’s revenue projections were greatly impacted by the concerning surge of compounded or imitation versions in the US. In an attempt to regain control, the company quickly issued more than 1,000 cease and desist letters and filed more than 130 lawsuits against compounding pharmacies. Notably, the FDA acknowledged worries about the increase in unregulated GLP-1 copies, many of which have resulted in dosage mistakes and potentially serious side effects, even as it emphasized the value of using approved medications.

Key Information About Novo Nordisk Weight Loss Drug (Wegovy & Related)

| Brand Name | Wegovy (semaglutide) |

|---|---|

| Manufacturer | Novo Nordisk |

| Drug Type | GLP-1 receptor agonist |

| Approved Use | Chronic weight management in adults and teens |

| Dosage Form | Weekly subcutaneous injection |

| Key Benefits | Appetite suppression, reduced food intake |

| Launch Year (US) | 2021 |

| Latest Markets | India (2025), China (limited uptake) |

| Common Side Effects | Nausea, vomiting, constipation |

| Rival Medications | Eli Lilly’s Zepbound, Mounjaro |

| Official Website | https://www.wegovy.com |

In the beginning, the introduction of Wegovy was heralded as a medical miracle for patients, especially those who were battling chronic obesity. Clinical studies showed that non-diabetic patients taking weekly doses of 20 mg could reduce their body weight by as much as 24 percent. The implications of these results are very clear: GLP-1 medications are not just cosmetic aids; they are essential in the fight against cardiovascular diseases linked to obesity. However, Novo’s market share has been severely weakened by patients seeking generic alternatives due to pricing and access disparities in markets such as the U.S. It is especially concerning when considering long-term obesity care that there is a disconnect between innovation and affordability.

Novo Nordisk aimed to counteract domestic setbacks by introducing Wegovy in 15 new countries in 2025. However, not every market reacted enthusiastically. For instance, adoption has been slower than expected in China. Executives pointed to slower market adaptation and logistical challenges as more urgent issues, even though competition was a minor factor. Novo is working to bridge that gap by making strategic investments in commercial execution and manufacturing infrastructure. A change in leadership was prompted by the company’s sharp decline in valuation, which went from $650 billion to just over $212 billion. Lars Fruergaard Jørgensen was replaced as CEO by Maziar Mike Doustdar, who was tasked with guiding the business toward greater stability.

This change represents more than just corporate reorganizations for the industry. Big Pharma’s focus has shifted over the last two years due to anti-obesity medications, with Zepbound from Eli Lilly swiftly surpassing Wegovy in terms of prescription volume in the US. Novo Nordisk is currently in a reactive position even though it was the first to market. Rising prices, complicated legal issues, and a particularly inventive competitor product have all contributed to the fragmentation of its once highly praised dominance. Analysts see this as a race to define the next generation of metabolic health care, not just a battle of brands.

Novo Nordisk wants to increase access while prioritizing safety by working with regulatory agencies and public health specialists. The business has demanded that the importation of active pharmaceutical ingredients used in compounded forms of its semaglutide medications be prohibited in the United States. In a field that is quickly moving into gray areas, this legal push is an effort to preserve therapeutic integrity and patient safety, not just profit margins. The estimate that more than 1 million Americans use illegal copies of semaglutide, many of which are not subject to routine safety checks, is especially concerning. The company wants to restore the credibility of its brand through more stringent regulations and increased public awareness.

Semaglutide and its offspring have the potential to completely transform long-term weight control in the years to come. These medications have the potential to drastically change the way obesity is treated internationally by lowering the risk of cardiovascular diseases and improving patients’ metabolic profiles. Celebrities, who frequently embrace medical innovations first, have already significantly contributed to the normalization of these procedures. This year’s award season saw a new wave of “Ozempic body” transformations sweeping the red carpet, according to astute observers. Unquestionably, this trend represents a change in the way society views pharmacological weight management, even though social media frequently spins it with both admiration and criticism.

Novo Nordisk is hoping to broaden Wegovy’s appeal by utilizing its well-established worldwide network and developing new medications, such as amycretin, which in early trials resulted in weight loss of up to 13% in just 12 weeks. This pipeline might be very effective at bolstering the business’s competitive advantage, particularly as customer demand rises rapidly. Simultaneously, the pharmaceutical industry is becoming more democratic. Competitors are noticeably bolder, regulators are more nimble, and patients are better informed.

Novo now commands a dominant 71% market share outside of the United States, and Wegovy’s unit volume has stabilized internationally since the beginning of 2025. The domestic conflict continues, however. Patient progress could be hampered by rising medication costs, uneven insurance coverage, and false information regarding compounded versions. Corporate responsibility is more important than ever in this situation. Novo Nordisk has the opportunity to establish a standard that goes beyond financial success by working with health systems and educating the public.