The S&P 500 Equal Weight Index has steadily changed the way people talk about passive investing over the last 20 years. The equal weight approach gives each component an equal influence rather than depending on a small number of tech giants to control performance, as is the case with the traditional S&P 500. It is remarkably successful at democratizing exposure, leveling the playing field for industries and sectors that are frequently eclipsed by the dominance of mega-caps. The equal weighting approach is a particularly advantageous substitute for investors weary of the volatility of companies like Apple and Nvidia.

Through equating the 500 biggest American corporations, this index disperses risk and opportunity throughout the whole economy. Regardless of market capitalization, each company has a constant 0.2% weight. Because of this structure, underappreciated healthcare organizations or lesser-known industries have just as much influence as the tech elite. This approach has produced noticeable performance benefits over time. Retail investors and institutional managers were interested in the Equal Weight Index because, from its launch until 2023, it beat the market-cap-weighted version by an average of 1.05% per year.

| Key Information | Details |

|---|---|

| Index Name | S&P 500 Equal Weight Index (SPXEW) |

| Launched | January 8, 2003 |

| Constituents | Same as S&P 500, equally weighted (0.2% each) |

| Rebalancing Frequency | Quarterly |

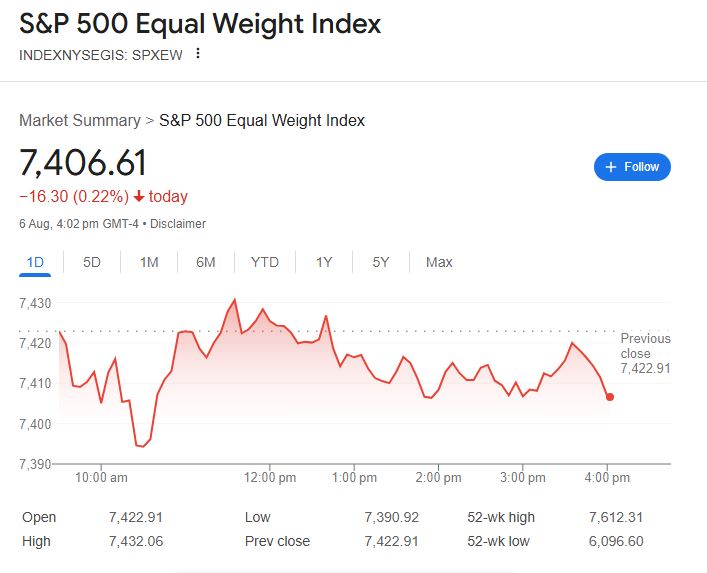

| Latest Value (as of August 6, 2025) | 7,406.61 |

| 52-Week High | 7,612.31 |

| 52-Week Low | 6,096.60 |

| 1-Year Return | +11.08% |

| Top ETFs Tracking This Index | Xtrackers, Invesco, iShares, Amundi |

However, performance has become more complex in recent years. The Equal Weight Index underperformed during their bull runs as a result of the so-called “Magnificent Seven” mega-cap tech stocks’ ascent, which greatly distorted traditional index returns upward. However, the Equal Weight Index showed remarkable resilience when corrections were implemented. Equal-weighted ETFs, like Invesco’s RSP or Xtrackers’ UCITS 1C, significantly increased overall portfolio resilience during tech pullbacks or inflationary environments that favored cyclicals.

The cost-effectiveness of tracking this index adds even more allure for ETF investors. Options such as the Amundi S&P 500 Equal Weight UCITS ETF or UBS’s equivalent provide exposure at surprisingly low rates, with total expense ratios ranging from 0.12% to 0.20% annually. The fees for actively managed funds, which frequently fall short of consistently outperforming their benchmarks, are much higher than this. Long-term investors seeking stability over hype continue to favor the index due to its low cost of access and strategic diversification.

It’s interesting to note that hedge fund managers and celebrity investors alike have quietly taken notice of the Equal Weight approach. Renowned investor Jim Cramer emphasized in a CNBC interview that Equal Weight indices more accurately represent the “average investor’s economy” as opposed to the distortions brought about by trillion-dollar tech valuations. Even though the Kardashians may not be tweeting about equal weight ETFs, a number of financial apps backed by celebrities have started to incorporate index options that incorporate these less well-known but incredibly effective assets.

The Equal Weight Index is a philosophical change from a societal standpoint. The appeal of equity and balance is especially strong in a time when concentration rules the financial industry and just five companies can account for more than 20% of an index. It reflects larger cultural shifts toward inclusion, justice, and decentralization. Similar to the increasing call for Big Tech antitrust laws, investors are choosing to shift their power to a broader sector. This is a cultural sentiment rather than merely portfolio theory.

Over the past year, industries like energy, materials, and financials have started to outperform as inflation has put pressure on margins and interest rates have remained high. These gains were felt more widely across the index because Equal Weight treats each sector more equally. The market-cap weighted S&P 500, on the other hand, was still closely associated with technology, which was subject to valuation compression. Retail participants were able to take advantage of this change without having to forecast it by investing in equal-weighted ETFs. In retrospect, that passive outperformance—motivated by rebalancing rather than speculation—is remarkably evident.

Quarterly rebalancing makes sure that no one stock has an excessive amount of influence. The index provides discipline that is frequently lacking in human-led portfolios by reducing winners and increasing laggards. It’s the investing counterpart of automatic portion control, which is a very effective strategy for controlling long-term profits. This approach is especially creative in avoiding emotional investing behaviors, even though it isn’t always glamorous.

The index has grown into sector-specific variants since its 2003 launch, including Equal Weighted Energy and Real Estate indices. Investors can isolate particular economic themes thanks to this customization, which keeps them safe from the top-heavy distortions found in conventional ETFs. For instance, the S&P 500 Equal Weight Energy Index attracted the attention of commodity-focused funds during the 2022 oil rally because it produced gains noticeably faster than broader indices.

Platforms like eToro and Robinhood have recently included equal weight options in their ETF screens for novice investors. Investor education is significantly improving as a result of this increased accessibility. Equal weight has started to appear in the vocabulary of financial influencers, ranging from TikTok personalities to YouTube finance channels. Even though it doesn’t trend like meme stocks or cryptocurrency, its consistency over time speaks louder.

Equal weight indexing seems especially logical in the face of macroeconomic uncertainty, where monetary policy and geopolitical tensions are still unpredictable. It asks you to have faith in the strength of the entire field rather than attempting to predict winners. That message strikes a deep chord, particularly with a generation that is wary of inequality. For investors looking for long-term growth, the S&P 500 Equal Weight Index offers a steady, well-thought-out route with its disciplined structure, diversified exposure, and surprisingly low entry points.